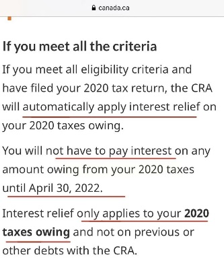

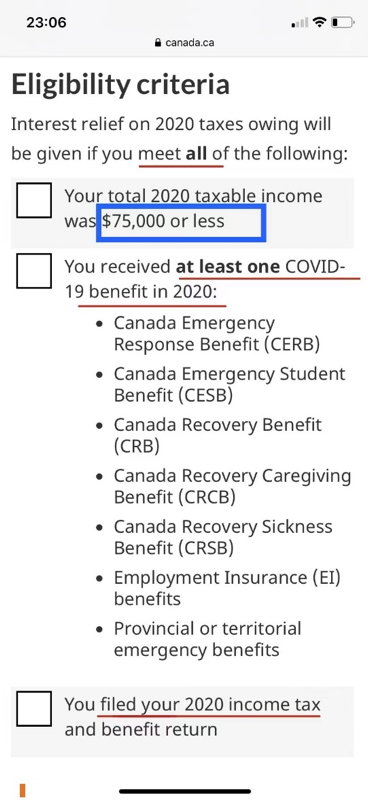

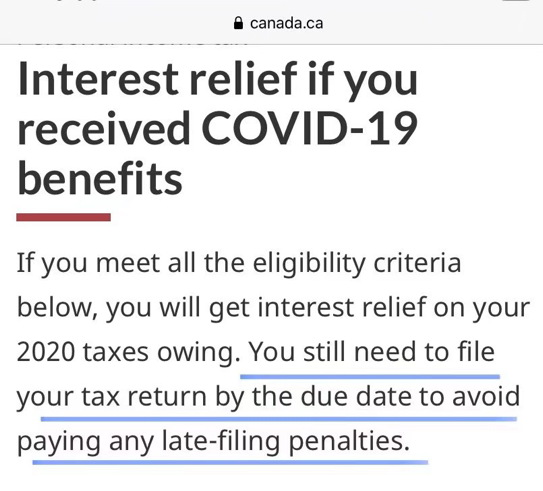

If you had a personal tax balance for year 2020, you maybe eligible for the extension of one year to pay the tax if you qualify all of the following:

Condition 1, your total taxable income not more than 75,000.

Condition 2, you received at least one of the covid-19 related benefits, such as CERB,CESB,CRB,CRCB,CRSB,EI or other provincial or territorial benefits.

Condition 3, you have filed your 2020 tax return.