The answer is it depends. Whether you need or when you need register GST depends on what kind of supplies you are providing and how much you make from your taxable supplies. If your business only provides exempted supplies then you cannot register a GST account. Generally, there are two conditions to be met to register GST:

First, you provide taxable supplies and second you are not small suppliers.

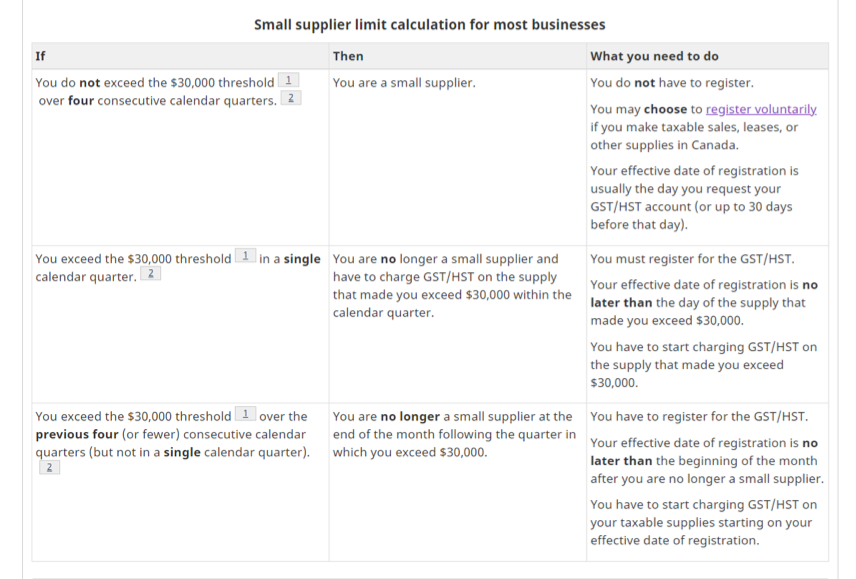

To qualify for a small supplier, your taxable supplies should not exceed 30,000 in a calendar quarter and the most recent consecutive four calendar quarters. ( Public service body not exceeding 50,000)

Please refer to the following to get an idea when small suppliers ceased to be a small supplier and need to register and charge GST.

You can also choose voluntarily register GST from the beginning of your business. It will be beneficial if from the start up period, your business got more ITC ( input tax credit) and you would like to claim a refund.

To Legend:Please add disclaimer “ The author of the article keeps the right of modification and explanation to the post. This article is only for general reference purpose and should not be used as guidance for specific tax situation . Please consult your accountant for your specific tax or accounting questions.”